The opinions expressed below are my own and do not necessarily represent those of Visdom Investment Group, LLC.

Criminal investigation

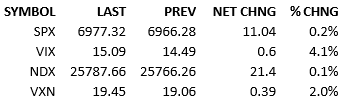

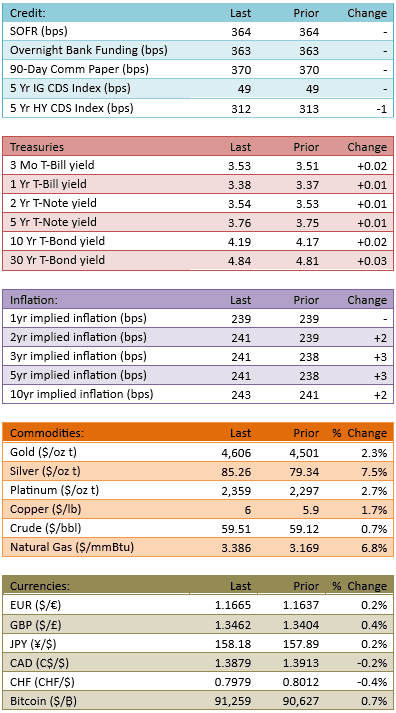

Last night we learned that the Department of Justice was launching a grand jury investigation of Chairman Powell. Futures fell immediately and markets were troubled by the news. This appears to be a politically motivated investigation and as details emerge, it does not seem reasonable that Chairman Powell committed the crimes cited. The S&P opened down about 30 points and rallied to flat by 11 AM. The index added some small gains in the afternoon. Yields climbed a couple bips across the curve and the probability of a Fed rate cut on January 28th is now just 5%.

Markets shrugged off the unprecedented news out of Washington. This is both surprising and not surprising. Criminally investigating a Central Bank Chairman because you don’t like his interest rate policies is a banana republic news item. It raises the possibility of a non-independent central bank materially. This is a serious concern to the Treasury market, and by extension, all other markets.

However markets didn’t worry much, or for long. Investors immediately understood the danger of the news but quickly realized that the DOJ investigation wouldn’t go anywhere and/or change anything. Perhaps markets have supreme faith in the US institutions themselves, that they cannot be manipulated, even by the President, to destroy what they were established for. Perhaps markets just characterized this as a typical Trump attack, although it is more serious than the usual name-calling.

We don’t know *why* markets moved on from this news so quickly but they did. And all we can do is presume that the markets have fairly discounted these events and their likely outcomes.

Moving on, earnings season is the business-as-usual topic on the front burner. Of the S&P 500 constituents, the big banks kick off the season tomorrow. Bank of New York and JP Morgan announce in the early morning. The preannouncement period has been quiet, which suggests disappointments will be few and far between. There’s no hype or excitement regarding the coming earnings season yet but that will change if some early results are big beats.

Investors are quite resilient at this moment in time and I expect them to chase offers higher if earnings results gives them a nice positive narrative to embrace.

See you tomorrow.

-Mike

Visdom Market Commentary

IMPORTANT INFORMATION

This is general educational information and market commentary and is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction.

All market and economic data herein is as of the date hereof and sourced from Bloomberg unless otherwise stated. The information is subject to change without notice and we have no obligation to update you.

This general market commentary is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. The views and opinions expressed constitute the author(s) judgment based on current market conditions, are subject to change without notice, and may differ from those expressed by other employees of Visdom Investment Group LLC ("Visdom") and Visdom. Past performance and any forward-looking statements are not guarantees of future results. It is not possible to invest directly in an index.

We believe the information contained in this material to be reliable and have sought to take reasonable care in its preparation; however, we do not represent or warrant its accuracy, reliability or completeness, or accept any liability for any loss or damage (whether direct or indirect) arising out of the use of all or any part of this material. Any securities referenced are shown for illustrative purposes only, and are not intended as a recommendation or endorsement by Visdom or by the author(s) in this context. The information presented is not intended to be making value judgments on the preferred outcome of any government decision. This information does not constitute Visdom research, nor should it be considered a recommendation of a particular investment strategy or an offer or solicitation for the purchase or sale of any financial instrument. Investing involves market risk, including the possible loss of principal. You should speak to your financial advisor before making any investment decisions. Visdom and its affiliates do not provide legal, tax or account advice so you should seek professional guidance if you have questions.