The opinions expressed below are my own and do not necessarily represent those of Visdom Investment Group, LLC.

Credit card cap

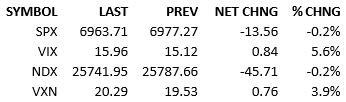

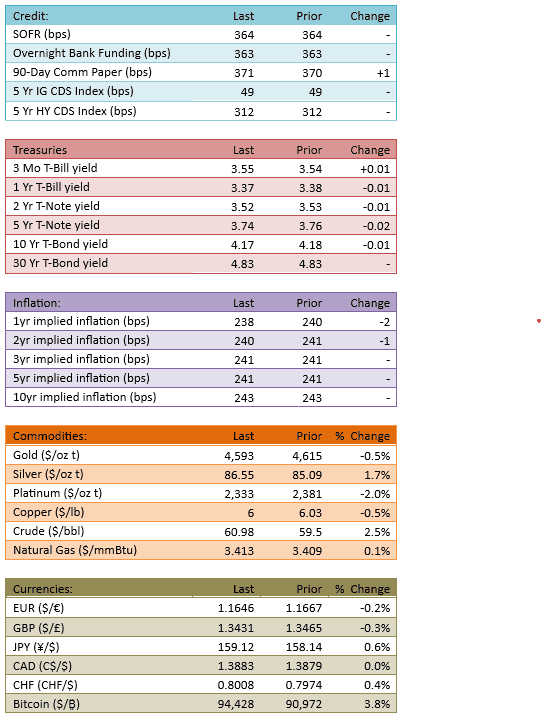

Today equities worried about the 10% interest rate cap on credit cards that President Trump announced last week. JPM is the poster child for this issue. The company beat estimates, traded up a bit in the premarket, opened slightly higher, and then faded fast, losing 3% by 10 AM and drifting further down over the day. The credit card complex was sold significantly today and JPM’s drop was a piece of that. Financials were the worst performing sector today and it seems they set the mood for the market. The yield curve didn’t change much and the probability of a 25-bip Fed cut in January is now down to 3%.

The start of earnings season should have kindled some bullish enthusiasm for the health of corporate results but the earliest reports were overshadowed by the credit card cap. This was a big news item when it broke last week but the market is taking it more seriously today. What was discounted as a mere Trumpism last week appears to be a pending policy implementation, which will have quite negative outcomes for not only the credit card businesses, but also those individuals who get shut out of the credit card market.

At this point, it looks like this will be quite a fight with lots of lobbying. The legislation is called the Credit Card Competition Act of 2023 and it’s been stalled (for obvious reasons) but has found new life with the President’s endorsement. Financials have performed very well and this looks like a hiccup in what’s been a more popular investment play. It probably makes sense to watch the financials for sentiment leadership.

Earnings season started a bit bumpily but there’s a lot yet to go. Let’s see if the market changes its narrative as more earnings reports come out and the credit card legislation changes via the official process.

See you tomorrow.

-Mike

Visdom Market Commentary

IMPORTANT INFORMATION

This is general educational information and market commentary and is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction.

All market and economic data herein is as of the date hereof and sourced from Bloomberg unless otherwise stated. The information is subject to change without notice and we have no obligation to update you.

This general market commentary is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. The views and opinions expressed constitute the author(s) judgment based on current market conditions, are subject to change without notice, and may differ from those expressed by other employees of Visdom Investment Group LLC ("Visdom") and Visdom. Past performance and any forward-looking statements are not guarantees of future results. It is not possible to invest directly in an index.

We believe the information contained in this material to be reliable and have sought to take reasonable care in its preparation; however, we do not represent or warrant its accuracy, reliability or completeness, or accept any liability for any loss or damage (whether direct or indirect) arising out of the use of all or any part of this material. Any securities referenced are shown for illustrative purposes only, and are not intended as a recommendation or endorsement by Visdom or by the author(s) in this context. The information presented is not intended to be making value judgments on the preferred outcome of any government decision. This information does not constitute Visdom research, nor should it be considered a recommendation of a particular investment strategy or an offer or solicitation for the purchase or sale of any financial instrument. Investing involves market risk, including the possible loss of principal. You should speak to your financial advisor before making any investment decisions. Visdom and its affiliates do not provide legal, tax or account advice so you should seek professional guidance if you have questions.