The opinions expressed below are my own and do not necessarily represent those of Visdom Investment Group, LLC.

No verdict, new highs

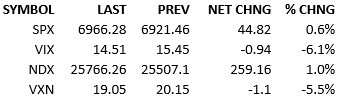

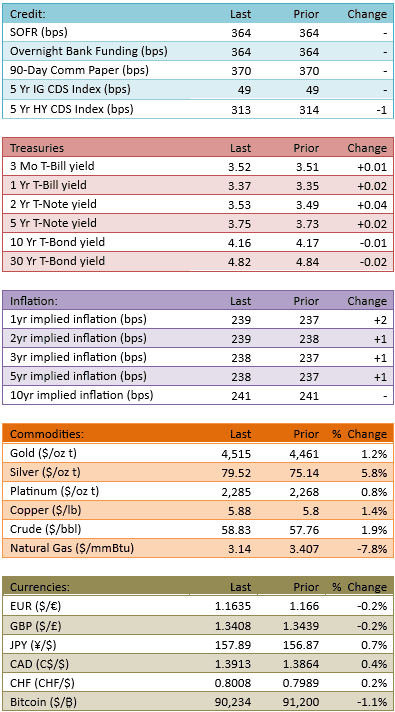

Overseas markets rallied but S&P 500 futures didn’t catch the fever. Futures were flat overnight and in early hours, only rallying a handful of points into the nonfarm payrolls release (+50k vs +70k est & +56k prior revised from +64k). This is a disappointing number but still shows a healthy labor market. The unemployment rate fell to 4.4% from 4.5%. Average hourly earnings surprised positively (+3.8% vs +3.6% est & 3.6% prior revised from 3.5%). The market welcomed these data. The labor market isn’t suggesting a precarious economic situation. The January Fed cut probabilities fell to 5%. The S&P opened +10 and slowly rallied further over the day. Shortly into trading, the Supreme Court said they would not deliver their tariff decision today and markets exhaled a bit. Usual January behavior ensued and we printed new all-time highs at lunchtime. The index added about 10 more points in the afternoon. Flow was typical, 100%.

The labor data didn’t significantly change the economic narrative, as expected. It did reinforce the story that the labor market is fine. This is a minor shift which is good for the economy but bad for Fed cut expectations. Nonfarm payrolls data is always important but today it didn’t move the markets much.

The Supreme Court ruling is now a day-to-day catalyst. It’ll arrive when it arrives but it’s probably not more than a business day or two away. The stories in the financial press indicate that *if* the tariffs are ruled illegal, the Trump administration will do something technically different but with a similar result. I don’t know about that but if that is true, the market probably won’t react too significantly. It’s anybody's guess though. We’ll just have to see.

It certainly seems as though markets aren’t *too* worried about the decision. This suggests that regardless of the decision, there’s not much downside risk. Hmmm. I think I agree but it’s a very interesting implication.

We’re more than a week into the new year and the January effect is on schedule. Next week earnings season kicks off.

I think the bulls have it made in the shade unless we get a bolt-from-the-blue.

See you Monday, have a great weekend.

-Mike

Visdom Market Commentary

IMPORTANT INFORMATION

This is general educational information and market commentary and is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction.

All market and economic data herein is as of the date hereof and sourced from Bloomberg unless otherwise stated. The information is subject to change without notice and we have no obligation to update you.

This general market commentary is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. The views and opinions expressed constitute the author(s) judgment based on current market conditions, are subject to change without notice, and may differ from those expressed by other employees of Visdom Investment Group LLC ("Visdom") and Visdom. Past performance and any forward-looking statements are not guarantees of future results. It is not possible to invest directly in an index.

We believe the information contained in this material to be reliable and have sought to take reasonable care in its preparation; however, we do not represent or warrant its accuracy, reliability or completeness, or accept any liability for any loss or damage (whether direct or indirect) arising out of the use of all or any part of this material. Any securities referenced are shown for illustrative purposes only, and are not intended as a recommendation or endorsement by Visdom or by the author(s) in this context. The information presented is not intended to be making value judgments on the preferred outcome of any government decision. This information does not constitute Visdom research, nor should it be considered a recommendation of a particular investment strategy or an offer or solicitation for the purchase or sale of any financial instrument. Investing involves market risk, including the possible loss of principal. You should speak to your financial advisor before making any investment decisions. Visdom and its affiliates do not provide legal, tax or account advice so you should seek professional guidance if you have questions.