The opinions expressed below are my own and do not necessarily represent those of Visdom Investment Group, LLC.

Tomorrow

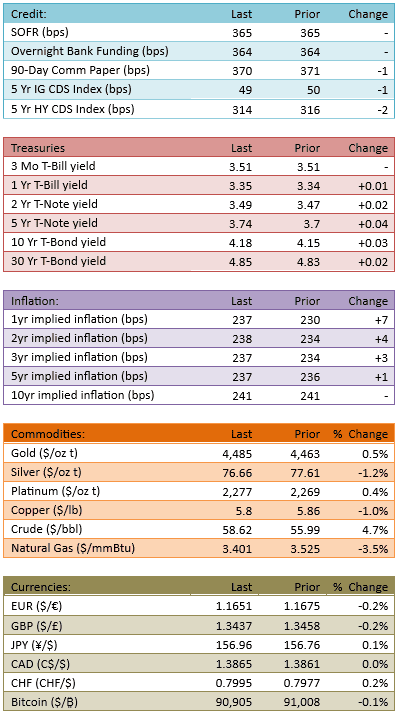

Overseas markets fell some and that spilled over into our premarket. Futures were down anywhere from 20 to 10 points in the wee hours of the morning. The S&P opened down about 10 and climbed to flat after 30 minutes. We spent the session trading around unchanged. Energy and consumer staples led while tech and healthcare lagged. Yields across the Treasury curve climbed a bit and the market is really backing off the expectation that the Fed will cut on January 28th. The current probability is priced at 12%.

Price action was uninteresting today and perhaps markets are waiting for tomorrow. December Nonfarm payrolls (+70k est & +64k prior) are a significant data release. Each month’s nonfarm payrolls data is key in the pricing mechanisms for markets. Data can always surprise us, but the likelihood is for something in line. We shall see. It makes sense to hold off on a big bullish or bearish push just ahead of the number. But tomorrow also has something important that isn’t on the macroeconomic calendar.

The Supreme Court

The Court is expected to rule on President Trump’s tariffs tomorrow.

That’s going to be a big event. I can’t speculate what markets might do if the verdict goes against the President or for him. It doesn’t look like the stock market is speculating either. Polymarket has the probability of the Court rejecting the tariffs is about 77%. It’s been about there since late November.

Does the market agree with Polymarket? Is a rejection mostly priced in?

I don’t have a clue. I do know that we are on the verge of learning the Court’s decision and the *stock* market isn’t trending ahead of the news. The market doesn’t have conviction that an outcome will have a strong directional result. So we’re treading water and waiting and watching.

This makes sense to me but if I had to guess, I think a rejection of the tariffs is coming and the result will be slightly bullish.

Be advised that I trust my guess as far as I can throw a piano. I’m quite confident that the Court’s decision will be very big news, which isn’t saying much.

See you tomorrow.

-Mike

Visdom Market Commentary

IMPORTANT INFORMATION

This is general educational information and market commentary and is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction.

All market and economic data herein is as of the date hereof and sourced from Bloomberg unless otherwise stated. The information is subject to change without notice and we have no obligation to update you.

This general market commentary is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. The views and opinions expressed constitute the author(s) judgment based on current market conditions, are subject to change without notice, and may differ from those expressed by other employees of Visdom Investment Group LLC ("Visdom") and Visdom. Past performance and any forward-looking statements are not guarantees of future results. It is not possible to invest directly in an index.

We believe the information contained in this material to be reliable and have sought to take reasonable care in its preparation; however, we do not represent or warrant its accuracy, reliability or completeness, or accept any liability for any loss or damage (whether direct or indirect) arising out of the use of all or any part of this material. Any securities referenced are shown for illustrative purposes only, and are not intended as a recommendation or endorsement by Visdom or by the author(s) in this context. The information presented is not intended to be making value judgments on the preferred outcome of any government decision. This information does not constitute Visdom research, nor should it be considered a recommendation of a particular investment strategy or an offer or solicitation for the purchase or sale of any financial instrument. Investing involves market risk, including the possible loss of principal. You should speak to your financial advisor before making any investment decisions. Visdom and its affiliates do not provide legal, tax or account advice so you should seek professional guidance if you have questions.