The opinions expressed below are my own and do not necessarily represent those of Visdom Investment Group, LLC.

Late rollover

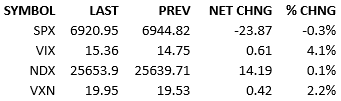

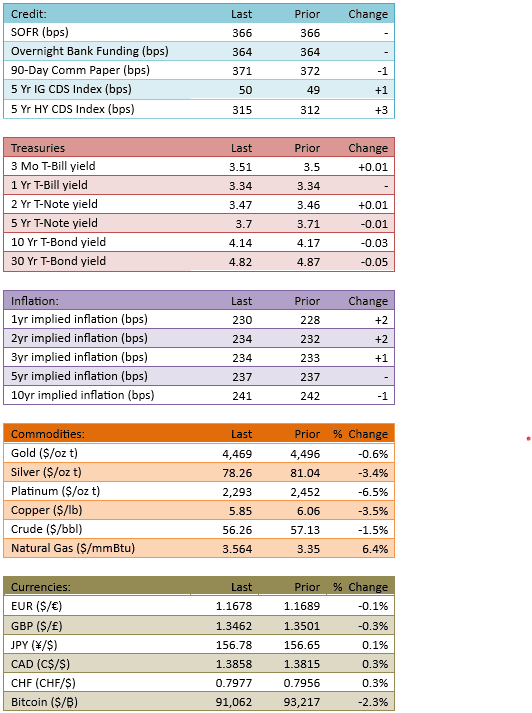

Overseas markets sold off some but S&P futures resisted the influence, only trading down 7-8 points in the premarket. They recovered into the open and the index itself opened about flat. The morning tendency for bullishness showed up on schedule and the S&P printed new all-time highs just before lunch. The yield curve flattened, with the back end coming in 1-5 bips, something that should’ve helped the bulls all day… but didn’t. After midday, the S&P drifted down to unch’d and went modestly negative in the final hour. Capital flow was about normal, 103%.

The morning’s ADP labor data (+41k vs +50k est & -29k prior revised from -32k) didn’t move markets. Despite it looking like a weak-labor surprise, markets barely jostled on the release. The existing narrative of the economy and the labor market remains as-is and investors went back to doing their usual, lifting prices. But then Trump said some things.

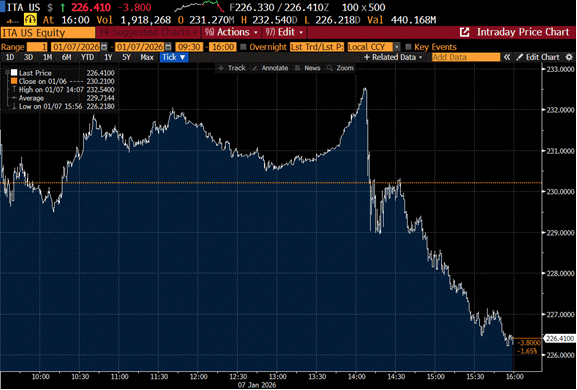

The most noteworthy Trump headline broke a little after 2 PM. He said he won’t allow defense companies to issue dividends or buy back their stock until the invest more in production and research. Here’s the intraday chart of an aerospace and defense ETF. Can you tell when the news broke? I’ll give you a hint, the market didn’t like that Trump pronouncement.

Anyway, Trump had many things to say this afternoon and they weren’t warmly received by the markets. While defense stocks don’t usually lead the market, today they were the lightning rod for negative sentiment. And once the chill started in defense stocks, it spread.

I don’t think this is a true investment landscape shift… but Trump just threw hit hat into the ring for forbidding and/or mandating capital actions out there in the market… that ain’t good for longs.

I think this just Trump being Trump. Breaking things with statements is his milieu.

Nut if these things go into effect, that would change the landscape. It’s not so much the direct effects of the specific things he wants *today.* It’s about what he wants *next.* It is well know what happens when you give someone an inch.

See you tomorrow.

-Mike

Visdom Market Commentary

IMPORTANT INFORMATION

This is general educational information and market commentary and is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction.

All market and economic data herein is as of the date hereof and sourced from Bloomberg unless otherwise stated. The information is subject to change without notice and we have no obligation to update you.

This general market commentary is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. The views and opinions expressed constitute the author(s) judgment based on current market conditions, are subject to change without notice, and may differ from those expressed by other employees of Visdom Investment Group LLC ("Visdom") and Visdom. Past performance and any forward-looking statements are not guarantees of future results. It is not possible to invest directly in an index.

We believe the information contained in this material to be reliable and have sought to take reasonable care in its preparation; however, we do not represent or warrant its accuracy, reliability or completeness, or accept any liability for any loss or damage (whether direct or indirect) arising out of the use of all or any part of this material. Any securities referenced are shown for illustrative purposes only, and are not intended as a recommendation or endorsement by Visdom or by the author(s) in this context. The information presented is not intended to be making value judgments on the preferred outcome of any government decision. This information does not constitute Visdom research, nor should it be considered a recommendation of a particular investment strategy or an offer or solicitation for the purchase or sale of any financial instrument. Investing involves market risk, including the possible loss of principal. You should speak to your financial advisor before making any investment decisions. Visdom and its affiliates do not provide legal, tax or account advice so you should seek professional guidance if you have questions.