The opinions expressed below are my own and do not necessarily represent those of Visdom Investment Group, LLC.

New all-time highs

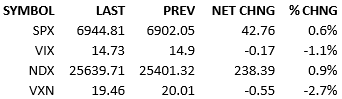

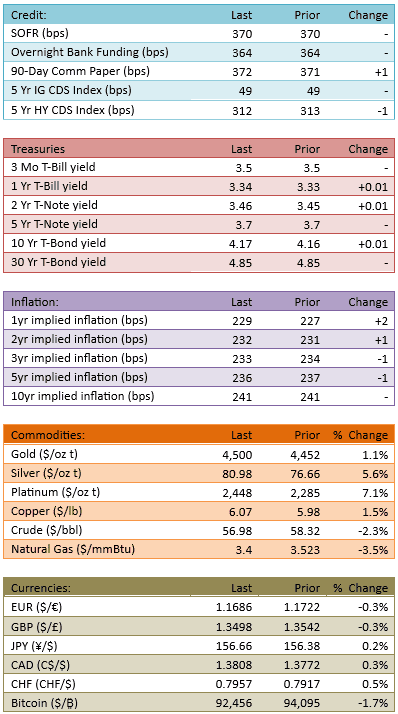

The bulls went to work at the open and they kept the tape climbing throughout the day. Headlines continue to be jam-packed with geopolitical news but not much is upsetting equity markets. January FOMC cut probability held at 17%. The yield curve steepened small. Materials and health care were the leading sectors today. The Mag 7 was mixed again. Capital flow was 108%, a sign that investors have begun an equity-allocation process in earnest.

Is this the January effect? It sure feels like it. News has not been a catalyst. Flows have been steady and elevated. Rallies are modest and broad. The chasing of AI stocks or the Mag 7 is absent. The markets are gobbling up stocks en masse but without freneticism. If you’re a bull, you call this a healthy sign of a mid-cycle bull market. If you’re a bear, you call it delusional continuation.

Setting that debate aside, the behavior should be our focus. Will this behavior continue? If we avoid some shocking headlines, yes. The investing population is *increasing* their equity exposure. Whether you think they are smart or dumb doesn’t alter the fact that the crowd is in motion and unlikely to simply get tired of lifting offers.

If the upward trend is to change, some shift in the investing landscape must occur. In the near term, macroeconomic data fits the bill. Labor data, in the form of ADP employment, weekly jobless, and nonfarm payrolls, arrives Wednesday, Thursday, and Friday respectively. Narrative-altering surprises in the labor market could certainly help the equity bears. That is a low probability risk however.

For the rest of the week, the probabilities favor the longs. Next week may make things more of a 50/50 proposition.

Inflation data and the first reports of earnings season are next week items. The potential for curveballs is higher then.

I think things look good for the bulls but if a bump in the road lies ahead, it’s probably not this week.

See you tomorrow.

-Mike

Visdom Market Commentary

IMPORTANT INFORMATION

This is general educational information and market commentary and is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction.

All market and economic data herein is as of the date hereof and sourced from Bloomberg unless otherwise stated. The information is subject to change without notice and we have no obligation to update you.

This general market commentary is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. The views and opinions expressed constitute the author(s) judgment based on current market conditions, are subject to change without notice, and may differ from those expressed by other employees of Visdom Investment Group LLC ("Visdom") and Visdom. Past performance and any forward-looking statements are not guarantees of future results. It is not possible to invest directly in an index.

We believe the information contained in this material to be reliable and have sought to take reasonable care in its preparation; however, we do not represent or warrant its accuracy, reliability or completeness, or accept any liability for any loss or damage (whether direct or indirect) arising out of the use of all or any part of this material. Any securities referenced are shown for illustrative purposes only, and are not intended as a recommendation or endorsement by Visdom or by the author(s) in this context. The information presented is not intended to be making value judgments on the preferred outcome of any government decision. This information does not constitute Visdom research, nor should it be considered a recommendation of a particular investment strategy or an offer or solicitation for the purchase or sale of any financial instrument. Investing involves market risk, including the possible loss of principal. You should speak to your financial advisor before making any investment decisions. Visdom and its affiliates do not provide legal, tax or account advice so you should seek professional guidance if you have questions.