The opinions expressed below are my own and do not necessarily represent those of Visdom Investment Group, LLC.

A down day.

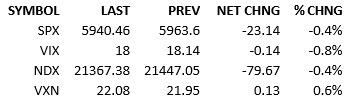

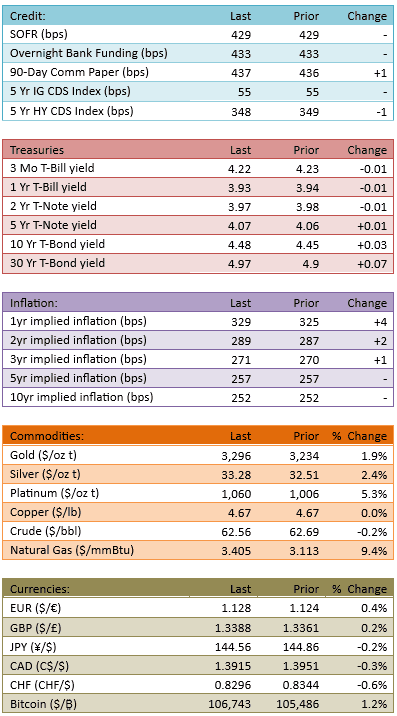

Overseas markets traded higher but S&P 500 futures didn’t follow suit. Premarket trading implied about 15 points of downside and the morning’s news and data was uninteresting. The usual dip-buyers didn’t make their mark after the open and the index traded around down 20 points for most of the day. The index fell further around 2:15 PM and briefly traded around -60 points. Dip-buyers didn’t tolerate that for long and repaired most of the damage in the final hour. Yields climbed a bit on the back end today and capital flow was quite light at 85%.

Unless we learn different, today feels like an unremarkable end to a winning streak. The S&P finished higher in each of the prior six sessions, adding about 5.3% in the run. The S&P managed to touch overbought levels on RSI indicators as well. The bears were probably due. It might not take long for the bulls to re-assume control of the tape shortly. The big picture looks compellingly bullish and, as we mentioned yesterday, sentiment is robust. It’s going to take an actual event, not just an exhaustion of buyers, to turn the tape south significantly.

New highs remain the consensus opinion. I am curious as to whether we’ll take a multi-session break before resuming the upside or not. Maybe the next pulse of buyers need to be inspired by an actual sequence of headlines? If we get a bullish burst of news, I think we’ll be into a fresh upward trend. If not, we may just need to wait a week for everyone to get past their hesitations and lift some offers again.

See you tomorrow.

-Mike

IMPORTANT INFORMATION

This is general educational information and market commentary and is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction.

All market and economic data herein is as of the date hereof and sourced from Bloomberg unless otherwise stated. The information is subject to change without notice and we have no obligation to update you.

This general market commentary is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. The views and opinions expressed constitute the author(s) judgment based on current market conditions, are subject to change without notice, and may differ from those expressed by other employees of Visdom Investment Group LLC ("Visdom") and Visdom. Past performance and any forward-looking statements are not guarantees of future results. It is not possible to invest directly in an index.

We believe the information contained in this material to be reliable and have sought to take reasonable care in its preparation; however, we do not represent or warrant its accuracy, reliability or completeness, or accept any liability for any loss or damage (whether direct or indirect) arising out of the use of all or any part of this material. Any securities referenced are shown for illustrative purposes only, and are not intended as a recommendation or endorsement by Visdom or by the author(s) in this context. The information presented is not intended to be making value judgments on the preferred outcome of any government decision. This information does not constitute Visdom research, nor should it be considered a recommendation of a particular investment strategy or an offer or solicitation for the purchase or sale of any financial instrument. Investing involves market risk, including the possible loss of principal. You should speak to your financial advisor before making any investment decisions. Visdom and its affiliates do not provide legal, tax or account advice so you should seek professional guidance if you have questions.