The opinions expressed below are my own and do not necessarily represent those of Visdom Investment Group, LLC.

Moody’s.

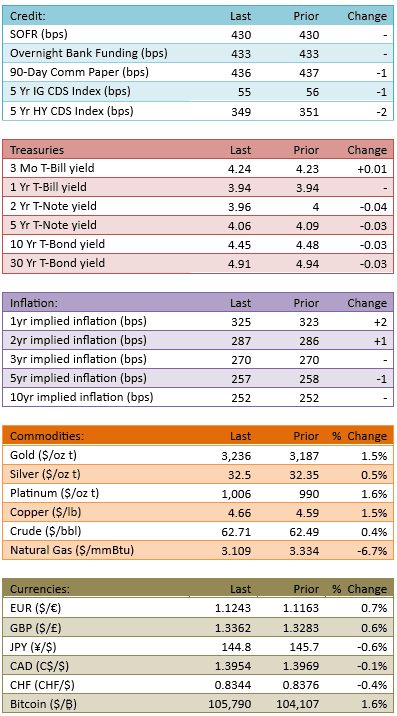

Moody’s downgraded the US credit rating and S&P 500 futures dropped significantly, as did Treasuries. The S&P opened down about 60 points and went to work climbing out of the hole right away. Treasury yields climbed only modestly early on. The market took note of the Moody’s downgrade but didn’t worry about it. The dip-buyers said thank you and lifted offers. Treasury buyers did the same as yields ended up *falling* by the afternoon. The S&P went positive at around 1 PM and stayed near Friday’s close for the bulk of the afternoon. Capital flow showed no signs of concern, printing a very light 85%.

Moody’s didn’t reference anything about the US government’s situation that the market didn’t already know, so that probably explains why both bond and stock bulls took advantage of the initial drop. The government should probably pay attention to Moody’s but that’s probably wishful thinking. The US deficit is too high but markets aren’t nervous about it *yet.* Moody’s just admitted that it was nervous but the market responded hat it was a worrywart. This is a bad situation in the big picture and in the future but for today, it was a bump in the road.

Today is a good gauge for the sentiment of the markets. We know we’ve been on a sentimental pendulum since the April lows. We know we’ve become progressively more optimistic about the future along the way. We didn’t know how robust our sentiment was though. If it were fragile, today would have cracked the sentimental shell around markets. It obviously didn’t.

Call it hubris, ignorance, or perceptive. Who knows what the optimistic attitude is actually rooted in. We’ll find out in time. In the here and now, the optimism is robust. There’s no derailing the bull until/unless we make new highs and/or a very recessionary headline/datapoint breaks.

The crowd is wildly bullish and it’s not going to abandon its view without a fight.

See you tomorrow.

-Mike

IMPORTANT INFORMATION

This is general educational information and market commentary and is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction.

All market and economic data herein is as of the date hereof and sourced from Bloomberg unless otherwise stated. The information is subject to change without notice and we have no obligation to update you.

This general market commentary is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. The views and opinions expressed constitute the author(s) judgment based on current market conditions, are subject to change without notice, and may differ from those expressed by other employees of Visdom Investment Group LLC ("Visdom") and Visdom. Past performance and any forward-looking statements are not guarantees of future results. It is not possible to invest directly in an index.

We believe the information contained in this material to be reliable and have sought to take reasonable care in its preparation; however, we do not represent or warrant its accuracy, reliability or completeness, or accept any liability for any loss or damage (whether direct or indirect) arising out of the use of all or any part of this material. Any securities referenced are shown for illustrative purposes only, and are not intended as a recommendation or endorsement by Visdom or by the author(s) in this context. The information presented is not intended to be making value judgments on the preferred outcome of any government decision. This information does not constitute Visdom research, nor should it be considered a recommendation of a particular investment strategy or an offer or solicitation for the purchase or sale of any financial instrument. Investing involves market risk, including the possible loss of principal. You should speak to your financial advisor before making any investment decisions. Visdom and its affiliates do not provide legal, tax or account advice so you should seek professional guidance if you have questions.