The opinions expressed below are my own and do not necessarily represent those of Visdom Investment Group, LLC.

The story is the story.

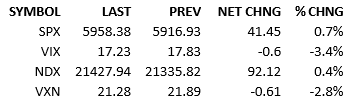

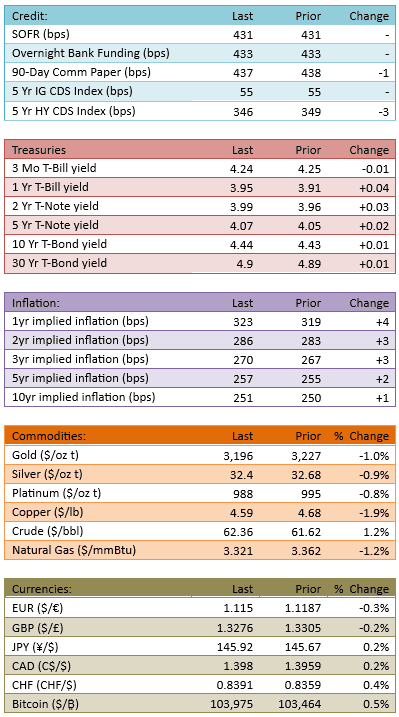

Overnight action was uninteresting and S&P 500 futures caught a bid with the opening of European trading. The futures indicated about 15 points of upside. The index opened up small and bobbed around for a couple hours. The bulls took over before midday and the rally gathered momentum in the afternoon. Capital flow was light at 92% and Treasury yields barely moved.

Why did we rally today? Because the market is going up. That’s the story and that’s the explanation. The headlines had little fundamental influence. The fact that the S&P climbed all five days this week was more significant as market chatter than anything else. The S&P is about 200 points away from the old highs and most equity investors are convinced that’s the next destination for stocks. How can one argue with them either?

There’s no fundamental danger lucking around the corner. Recession risk is melting away. Polymarket currently prices a US recession in 2025 at 36% but most economists on the street have chopped their recession risks significantly and markets are not pricing recession risks with any notable conviction.

The stock market is dipping its toe into euphoric sentimental waters. At some point, the sentiment will be too wildly optimistic but we are not there yet. We have to overswing to an absurd degree.

So get ready for some boom-time bullish hyper-happiness. This party is roaring. I worry about the end but until it does end, it’s going to be an orgy of upside.

See you Monday, have a great weekend.

-Mike

IMPORTANT INFORMATION

This is general educational information and market commentary and is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction.

All market and economic data herein is as of the date hereof and sourced from Bloomberg unless otherwise stated. The information is subject to change without notice and we have no obligation to update you.

This general market commentary is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. The views and opinions expressed constitute the author(s) judgment based on current market conditions, are subject to change without notice, and may differ from those expressed by other employees of Visdom Investment Group LLC ("Visdom") and Visdom. Past performance and any forward-looking statements are not guarantees of future results. It is not possible to invest directly in an index.

We believe the information contained in this material to be reliable and have sought to take reasonable care in its preparation; however, we do not represent or warrant its accuracy, reliability or completeness, or accept any liability for any loss or damage (whether direct or indirect) arising out of the use of all or any part of this material. Any securities referenced are shown for illustrative purposes only, and are not intended as a recommendation or endorsement by Visdom or by the author(s) in this context. The information presented is not intended to be making value judgments on the preferred outcome of any government decision. This information does not constitute Visdom research, nor should it be considered a recommendation of a particular investment strategy or an offer or solicitation for the purchase or sale of any financial instrument. Investing involves market risk, including the possible loss of principal. You should speak to your financial advisor before making any investment decisions. Visdom and its affiliates do not provide legal, tax or account advice so you should seek professional guidance if you have questions.