The opinions expressed below are my own and do not necessarily represent those of Visdom Investment Group, LLC.

Everything’s in motion.

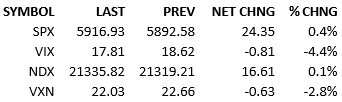

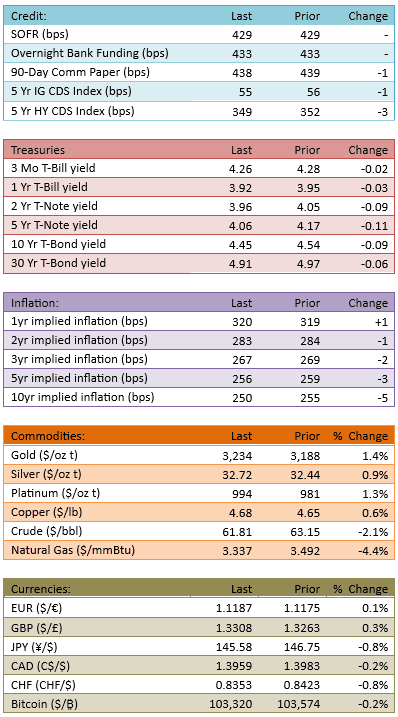

Futures traded down to as much as -40 points in the early hours but they began to recover as we approached the open. Weekly jobless data (229k vs 228k est & 229k prior revised from 228k) gave no hint of US economic hiccups and other economic data, retail sales and PPI, rattled no cages. The S&P opened down about 20 and rallied consistently after about an hour of wandering around the opening prices. The index went positive before lunch and held a respectable gain for the rest of the session. News headlines weren’t compelling and capital flow normalized to 100%. Yields fell across the curve and for the first time this week.

Inertia presently exists and it’s on the side of the bulls. Headlines are uneventful and the scars of April remain the primary influence on current attitudes. The S&P is well off the bottom, the retest wasn’t even close to the April 7th lows, the subsequent rally is nearly without a downtick, and the market has broken above the major moving averages with conviction.

If that’s the narrative, what’s to keep sentiment from improving further? The answer is negative news, which isn’t breaking. As long as policy makers stay quiet, investor optimism will swell. The current cycle, of better feelings pushing prices higher resulting in feeling even better, is about one month old but also unbroken. It also doesn’t appear to be on its last legs. It feels like there is still room to run.

And if that’s how everyone feels, that’s how it’ll play out.

Riding the rally upward to new highs is the consensus play. Just because it’s consensus doesn’t make it wrong. It does make me nervous.

See you tomorrow.

-Mike

IMPORTANT INFORMATION

This is general educational information and market commentary and is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction.

All market and economic data herein is as of the date hereof and sourced from Bloomberg unless otherwise stated. The information is subject to change without notice and we have no obligation to update you.

This general market commentary is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. The views and opinions expressed constitute the author(s) judgment based on current market conditions, are subject to change without notice, and may differ from those expressed by other employees of Visdom Investment Group LLC ("Visdom") and Visdom. Past performance and any forward-looking statements are not guarantees of future results. It is not possible to invest directly in an index.

We believe the information contained in this material to be reliable and have sought to take reasonable care in its preparation; however, we do not represent or warrant its accuracy, reliability or completeness, or accept any liability for any loss or damage (whether direct or indirect) arising out of the use of all or any part of this material. Any securities referenced are shown for illustrative purposes only, and are not intended as a recommendation or endorsement by Visdom or by the author(s) in this context. The information presented is not intended to be making value judgments on the preferred outcome of any government decision. This information does not constitute Visdom research, nor should it be considered a recommendation of a particular investment strategy or an offer or solicitation for the purchase or sale of any financial instrument. Investing involves market risk, including the possible loss of principal. You should speak to your financial advisor before making any investment decisions. Visdom and its affiliates do not provide legal, tax or account advice so you should seek professional guidance if you have questions.