The opinions expressed below are my own and do not necessarily represent those of Visdom Investment Group, LLC.

Spooked.

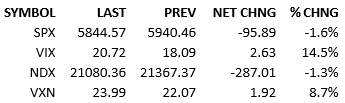

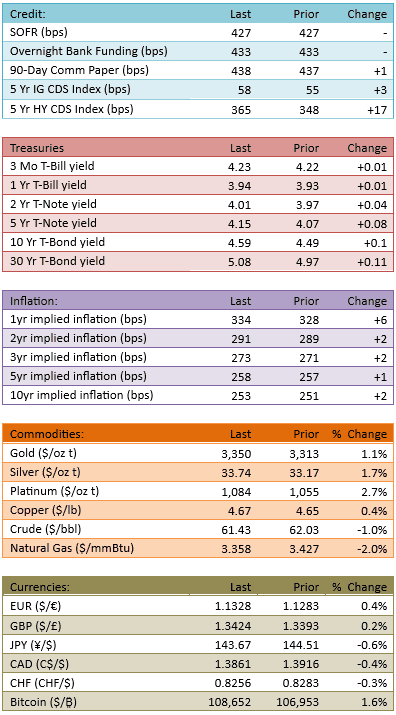

Futures traded off a bit overnight and the index opened down about 35 points. Treasury yields had climbed in the early morning and the 30-year broke above 5%. The 5% yield level was a psychological threshold that injected some worry into the stock market. Apparently, yields getting over 5% was more worrisome than the Moody’s downgrade. Anyway, the dip-buyers saw the down open as another opportunity and pushed the index almost to unch’d by midday, at which point the 20-year Treasury auction results came out. It was a weak auction. Cue up all the fears of the morning and then some. The S&P dropped 70 points in a handful of minutes. Over the rest of the session, higher yield talk and worries about the bond market spread, resulting in further weakness for stocks over the remainder of the day. For all of the drama, capital flow was only 104%.

The aggressive bounce stalled yesterday and today it hit a snag. This was due to a fundamental development. This isn’t a bolt-from-the-blue event but it was surprising. All market participants understand that the Treasury market’s climbing yields were of *some* concern. It was unknown *at what point* the higher rates would matter. Turns out 5% for the back end of the curve is the point. Additionally, all market participants understood that a weaker Treasury auction was a risk. It was unknown, *if* a weak auction was going to show up. Turns out, today it did.

We are now sensitized to the risks of the bond market and the fiscal situation of the US government. If things get worse on that front, stocks will suffer. It remains to be seen if a couple of strong auctions will cure the current sentimental ailments.

Back when US Treasury auctions were of great concern, there were a couple of weak ones that scared everyone greatly. They were followed by strong auctions, which made everything better and everyone went back to buying the dips and adding risk.

That’s the playbook everyone has open at the moment. It’ll work when we get a string of strong Treasury auctions. When’s that going to happen?

Time to watch and wait.

See you tomorrow.

-Mike

IMPORTANT INFORMATION

This is general educational information and market commentary and is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction.

All market and economic data herein is as of the date hereof and sourced from Bloomberg unless otherwise stated. The information is subject to change without notice and we have no obligation to update you.

This general market commentary is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. The views and opinions expressed constitute the author(s) judgment based on current market conditions, are subject to change without notice, and may differ from those expressed by other employees of Visdom Investment Group LLC ("Visdom") and Visdom. Past performance and any forward-looking statements are not guarantees of future results. It is not possible to invest directly in an index.

We believe the information contained in this material to be reliable and have sought to take reasonable care in its preparation; however, we do not represent or warrant its accuracy, reliability or completeness, or accept any liability for any loss or damage (whether direct or indirect) arising out of the use of all or any part of this material. Any securities referenced are shown for illustrative purposes only, and are not intended as a recommendation or endorsement by Visdom or by the author(s) in this context. The information presented is not intended to be making value judgments on the preferred outcome of any government decision. This information does not constitute Visdom research, nor should it be considered a recommendation of a particular investment strategy or an offer or solicitation for the purchase or sale of any financial instrument. Investing involves market risk, including the possible loss of principal. You should speak to your financial advisor before making any investment decisions. Visdom and its affiliates do not provide legal, tax or account advice so you should seek professional guidance if you have questions.