The opinions expressed below are my own and do not necessarily represent those of Visdom Investment Group, LLC.

90 Days.

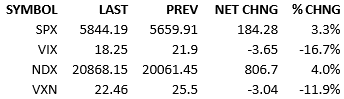

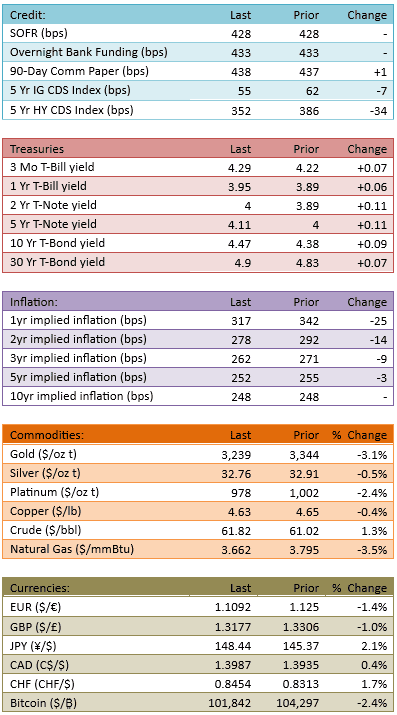

For 90 days, the US is dropping tariff rates on China to 30% and China is dropping tariff rates on the US to 10%. That leaves a window of *some* trade within which, it is hoped, both countries can come to a long-term trade agreement. Investors viewed this as an unwinding of Liberation Day tariffs and equity futures zoomed higher overnight. The S&P 500 opened up around +2.5% and rallied even higher in the afternoon. Capital flow was higher today at 119% but I’m surprised it wasn’t higher. Yields climbed significantly across the curve too and the market only expects 57 bips of Fed rate cuts this year now. In April, during the most negative days, markets expected 100-plus bips of cuts.

So the tariff talk finally morphed into a compelling and positive catalyst for the markets, and the economy. US recession probabilities for 2025 dropped to 39% on Polymarket today. That’s a huge drop and every dip-buyer in the last month is vindicated yet again, if the US economy dodges a recession. The risk remains high but the tariff talk just became a bump in the road for the economy instead of a trench.

Can the economy handle it without triggering a negative cascade? Probably, but the tariff situations need to be resolved quickly. If these 90-day tariffs get extended instead of negotiated away, that’s going to leave a mark on the economy. How bad a mark remains to be seen.

But for the moment, everything is coming up roses for the stock market. It looks like market psychology has materially shifted into bull market thinking. Investors are looking towards prior all-time highs (6147 on S&P) and assuming that we are heading back to those levels in short order. *Unless* we see horrible economic data here’s the narrative that is spurring a new impulse of bullishness in the market.

There will be no recession, the trade landscape will not be a drag, the US earnings outlook is about to benefit from lots of upward revisions, and we are going back to peak valuation multiples.

Whether one agrees with this or not isn’t significant. This is the narrative. This is the attitude. This is going to be the elevator pitch for every long for the next month. It won’t just fade away on it’s own and it won’t stop after reaching overbought technical conditions. We’re going to have to smash through overbought technical conditions and live there for a while.

See you tomorrow.

-Mike

IMPORTANT INFORMATION

This is general educational information and market commentary and is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction.

All market and economic data herein is as of the date hereof and sourced from Bloomberg unless otherwise stated. The information is subject to change without notice and we have no obligation to update you.

This general market commentary is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. The views and opinions expressed constitute the author(s) judgment based on current market conditions, are subject to change without notice, and may differ from those expressed by other employees of Visdom Investment Group LLC ("Visdom") and Visdom. Past performance and any forward-looking statements are not guarantees of future results. It is not possible to invest directly in an index.

We believe the information contained in this material to be reliable and have sought to take reasonable care in its preparation; however, we do not represent or warrant its accuracy, reliability or completeness, or accept any liability for any loss or damage (whether direct or indirect) arising out of the use of all or any part of this material. Any securities referenced are shown for illustrative purposes only, and are not intended as a recommendation or endorsement by Visdom or by the author(s) in this context. The information presented is not intended to be making value judgments on the preferred outcome of any government decision. This information does not constitute Visdom research, nor should it be considered a recommendation of a particular investment strategy or an offer or solicitation for the purchase or sale of any financial instrument. Investing involves market risk, including the possible loss of principal. You should speak to your financial advisor before making any investment decisions. Visdom and its affiliates do not provide legal, tax or account advice so you should seek professional guidance if you have questions.