The opinions expressed below are my own and do not necessarily represent those of Visdom Investment Group, LLC.

Quiet day.

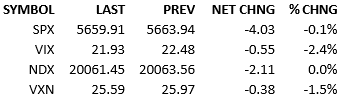

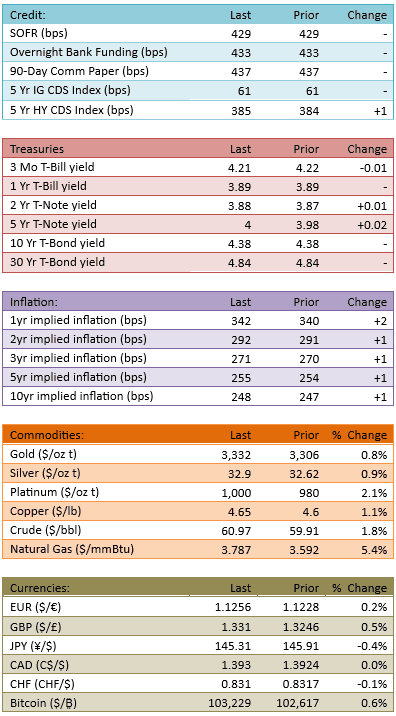

Headlines and data didn’t stir the pot today and futures traded mostly flat overnight. They caught a bit of a bid into the open and the S&P 500 started the session around +20 points. The index hung around that level for about 40 minutes and then dropped to flat. The index wandered about that level for the rest of the day on very light capital flow, 78%. The Treasury market also moved trivially and FOMC cuts for the year decreased slightly to 66 bips. Broadly speaking, not much happened.

Stocks and bonds took a breather but commodities continue to dance about. I’m not sure if there’s a meaningful conclusion to draw from the shenanigans occurring in the commodity space but it’s captured some people’s attention. Gold has been the best performing asset for a while and on-again, off-again commodity traders are getting lured back into the space thanks to the gold. Some are attempting to draw a larger conclusion that a massive shift in psychology towards the entire asset class is en route. I don’t know about that but certainly the asset class has been neglected over the years.

Discussing commodities, even in passing, is a sign of how little there is to discuss in the major markets.

Honestly, the world changed very little today, including psychological investing attitudes. As a result, the markets did very little and investors were happy to go through the motions and get to the weekend.

See you Monday.

-Mike

IMPORTANT INFORMATION

This is general educational information and market commentary and is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction.

All market and economic data herein is as of the date hereof and sourced from Bloomberg unless otherwise stated. The information is subject to change without notice and we have no obligation to update you.

This general market commentary is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. The views and opinions expressed constitute the author(s) judgment based on current market conditions, are subject to change without notice, and may differ from those expressed by other employees of Visdom Investment Group LLC ("Visdom") and Visdom. Past performance and any forward-looking statements are not guarantees of future results. It is not possible to invest directly in an index.

We believe the information contained in this material to be reliable and have sought to take reasonable care in its preparation; however, we do not represent or warrant its accuracy, reliability or completeness, or accept any liability for any loss or damage (whether direct or indirect) arising out of the use of all or any part of this material. Any securities referenced are shown for illustrative purposes only, and are not intended as a recommendation or endorsement by Visdom or by the author(s) in this context. The information presented is not intended to be making value judgments on the preferred outcome of any government decision. This information does not constitute Visdom research, nor should it be considered a recommendation of a particular investment strategy or an offer or solicitation for the purchase or sale of any financial instrument. Investing involves market risk, including the possible loss of principal. You should speak to your financial advisor before making any investment decisions. Visdom and its affiliates do not provide legal, tax or account advice so you should seek professional guidance if you have questions.