The opinions expressed below are my own and do not necessarily represent those of Visdom Investment Group, LLC.

Rejuvenation.

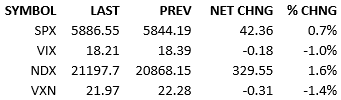

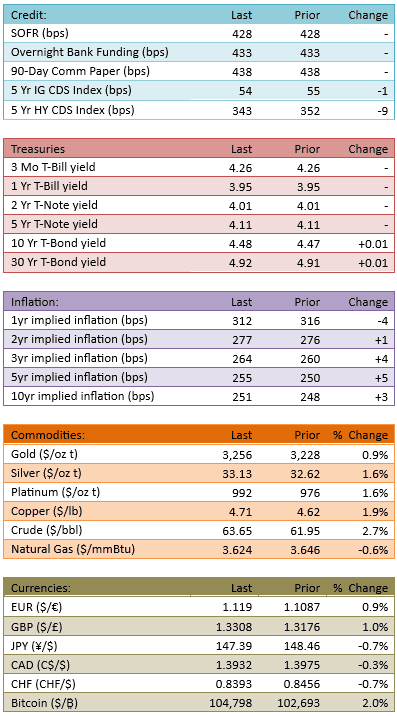

Futures faded small last night but caught a bit of a bid into the open and the S&P 500 opened slightly positive. The index ramped quickly during regular trading and was +45 within an hour, climbing slowly further over the rest of the session. The big story of the day concerns the investment announcements and defense purchase announcement with Saudi Arabia. Stocks used the news as a reason to continue the upside momentum and forecast a rosy economic outlook. Bonds didn’t do too much but slightly higher yields could been interpreted as corroborating the economy-will-strengthen narrative. Fed funds markets now price 52 bips of cuts for 2025, so that market also is less and less worried about the health of the economy. Capital flow was slightly elevated at 115%, suggesting the large pools of capital are going into motion.

The Saudi Arabia deal has been labeled, by the President, as a trillion-dollar deal, although the numbers posted at the conference itself say $300 billion and the White House says $600 billion. Obviously the President sells the sizzle and not the steak and who knows how much money Saudi Arabia actually spends/invests. By the time we actually know, it’ll be years from now and this announcement is more public relations, or investor relations, than anything else. We’ve been in a sentiment market for a while and this is the latest sentiment-driving news story. For investors, who cares how much of it is true? The mood was good and now the mood is cheerful.

Stocks are going up significantly and consistently and lots of capital is getting into motion. That’s a recipe for a trend and so there are a lot of investors getting long with gusto now, assuming that slower capital will eventually read the room and get going on the long side in the coming weeks. Barring a bombshell news story, it seems that we are on a path to new highs. That’s only 4.4% away. We could be there by the end of the week, certainly by month-end.

*If* we do return to the old highs, and make new ones, the market will confidently proclaim that the bull market never left us and we should all return to our behaviors from 2023 and 2024.

I can’t argue with that thinking either. I may argue that the valuations don’t justify that outcome but when the market perceives that we’re in a healthy bull market, valuations don’t matter and upside is the only side.

See you tomorrow.

-Mike

IMPORTANT INFORMATION

This is general educational information and market commentary and is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction.

All market and economic data herein is as of the date hereof and sourced from Bloomberg unless otherwise stated. The information is subject to change without notice and we have no obligation to update you.

This general market commentary is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. The views and opinions expressed constitute the author(s) judgment based on current market conditions, are subject to change without notice, and may differ from those expressed by other employees of Visdom Investment Group LLC ("Visdom") and Visdom. Past performance and any forward-looking statements are not guarantees of future results. It is not possible to invest directly in an index.

We believe the information contained in this material to be reliable and have sought to take reasonable care in its preparation; however, we do not represent or warrant its accuracy, reliability or completeness, or accept any liability for any loss or damage (whether direct or indirect) arising out of the use of all or any part of this material. Any securities referenced are shown for illustrative purposes only, and are not intended as a recommendation or endorsement by Visdom or by the author(s) in this context. The information presented is not intended to be making value judgments on the preferred outcome of any government decision. This information does not constitute Visdom research, nor should it be considered a recommendation of a particular investment strategy or an offer or solicitation for the purchase or sale of any financial instrument. Investing involves market risk, including the possible loss of principal. You should speak to your financial advisor before making any investment decisions. Visdom and its affiliates do not provide legal, tax or account advice so you should seek professional guidance if you have questions.