The opinions expressed below are my own and do not necessarily represent those of Visdom Investment Group, LLC.

Fed pleases the bulls.

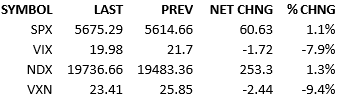

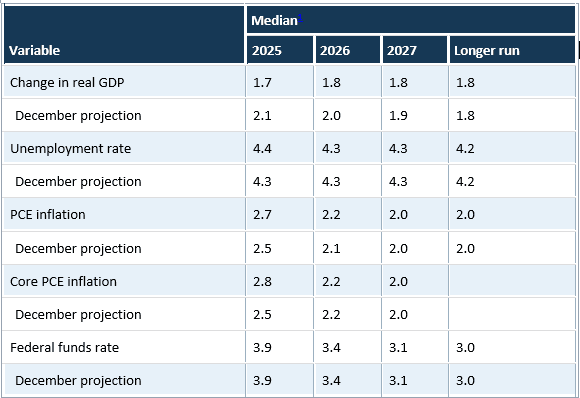

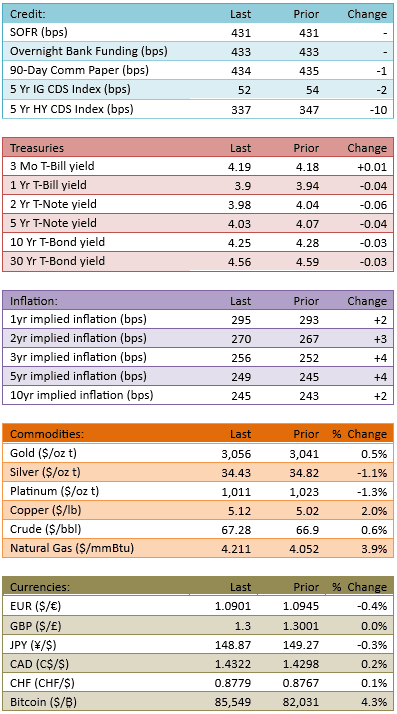

The market opened up about 20 points and hung out around there for the day, only breaking out after the FOMC decision. The Fed left rates unchanged, as expected. The Dot-plot showed slightly fewer rate cuts than in the previous. GDP expectations were down a bit but still showed respectable growth. Inflation expectations bumped up a little but returns to the prior downward path after 2025.All in all, the Fed is not expecting enough slowing to have to alter their prior expected cutting path and they don’t see inflation misbehaving in a way that would require them hiking rates and breaking the economy. Treasury yields fell small and stocks rallied sharply.

The Fed statement and the Chairman’s press conference both worked wonders for the longs. The Fed doesn’t expect the tariff impacts to be significant. The Fed doesn’t see inflation popping up too much and they see inflation dropping later. The Fed sees a bit of a reduction in GDP but nothing too significant. Here’s the data from the Summary of Economic Projections.

This shows that all the drama of the last four weeks, which has forced investors to rethink the state of things, hasn’t changed Fed policy nor their outlook. They are seeing blue skies ahead and the market latched on to that view. Shorts got squeezed out and dip-buyers regained their confidence.

The Fed renewed its status as a friend of the bulls and the 200-day moving average (5746) is back in play. If the Fed is correct, then maybe this correction is done. If things worsen, then both the market and the Fed will be surprised and we should expect extra volatility as both investors and Fed officials will need to change on the fly.

At the moment, it’s steady as she goes. For the bulls, that means hitting the buy buttons.

See you tomorrow.

-Mike

IMPORTANT INFORMATION

This is general educational information and market commentary and is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction.

All market and economic data herein is as of the date hereof and sourced from Bloomberg unless otherwise stated. The information is subject to change without notice and we have no obligation to update you.

This general market commentary is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. The views and opinions expressed constitute the author(s) judgment based on current market conditions, are subject to change without notice, and may differ from those expressed by other employees of Visdom Investment Group LLC ("Visdom") and Visdom. Past performance and any forward-looking statements are not guarantees of future results. It is not possible to invest directly in an index.

We believe the information contained in this material to be reliable and have sought to take reasonable care in its preparation; however, we do not represent or warrant its accuracy, reliability or completeness, or accept any liability for any loss or damage (whether direct or indirect) arising out of the use of all or any part of this material. Any securities referenced are shown for illustrative purposes only, and are not intended as a recommendation or endorsement by Visdom or by the author(s) in this context. The information presented is not intended to be making value judgments on the preferred outcome of any government decision. This information does not constitute Visdom research, nor should it be considered a recommendation of a particular investment strategy or an offer or solicitation for the purchase or sale of any financial instrument. Investing involves market risk, including the possible loss of principal. You should speak to your financial advisor before making any investment decisions. Visdom and its affiliates do not provide legal, tax or account advice so you should seek professional guidance if you have questions.