The opinions expressed below are my own and do not necessarily represent those of Visdom Investment Group, LLC.

It ain’t gonna be easy.

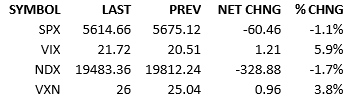

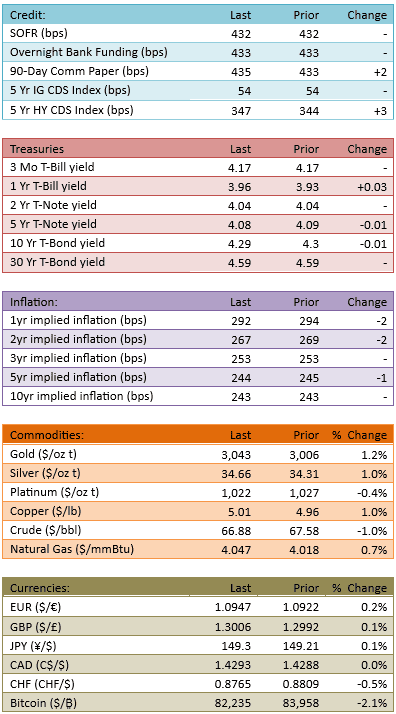

Dip-buyers and bounce-players couldn’t get a 3rd win today. Futures were down 20 points around midnight but returned to flat once Europe began trading. The bears controlled things from then on. The data and news today weren’t all that revealing and the S&P opened the session -25 points. Prices slipped quickly and by 10 AM, we’d found the trading range for the rest of the day, -75 to -50 points. Yields didn’t do much today and Fed Funds didn’t change much either. There’s 59 bips of cuts priced by year-end now, only a bip different from yesterday.

Today was simply a shift in sentiment. The news was not a factor in any particular sense. Maybe the overall negative tone of the news cycle plays a role in a generally bearish feel of the equity market today but that’s a speculation on my part.

Let’s assume we don’t have a clear why to identify, that explains today’s bearish turn. It just showed up and now we have to deal with it. These things happen in markets. They just haven’t happened much in the last two years and I’m sure some investors forgot that this is part of the normal market environment.

Anyway, sentiment is a dynamic element in the market currently. There’s no longer a sentiment trend that you can hop on and ride with confidence. We are day-to-day. This is going to shake out a lot of people, especially if things get dicey.

Tomorrow the Fed announces the next rate policy decision. The overwhelming consensus is that no changes will be made. The futures market prices a 25 bip cut with less than 1% probability. We are in familiar territory with the Fed tomorrow. They will do nothing and we will torture the statement for hidden meaning. We will over-analyze the word choices of Chairman Powell during the press conference.

The bulls are looking for statements of economic strength and hints of dovishness, allowing the economy to run.

Bears are looking for statements of inflationary concern and hints of dovishness, in an attempt to head off a recession.

We’ll see who’s happy tomorrow afternoon.

See you tomorrow.

-Mike

IMPORTANT INFORMATION

This is general educational information and market commentary and is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction.

All market and economic data herein is as of the date hereof and sourced from Bloomberg unless otherwise stated. The information is subject to change without notice and we have no obligation to update you.

This general market commentary is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. The views and opinions expressed constitute the author(s) judgment based on current market conditions, are subject to change without notice, and may differ from those expressed by other employees of Visdom Investment Group LLC ("Visdom") and Visdom. Past performance and any forward-looking statements are not guarantees of future results. It is not possible to invest directly in an index.

We believe the information contained in this material to be reliable and have sought to take reasonable care in its preparation; however, we do not represent or warrant its accuracy, reliability or completeness, or accept any liability for any loss or damage (whether direct or indirect) arising out of the use of all or any part of this material. Any securities referenced are shown for illustrative purposes only, and are not intended as a recommendation or endorsement by Visdom or by the author(s) in this context. The information presented is not intended to be making value judgments on the preferred outcome of any government decision. This information does not constitute Visdom research, nor should it be considered a recommendation of a particular investment strategy or an offer or solicitation for the purchase or sale of any financial instrument. Investing involves market risk, including the possible loss of principal. You should speak to your financial advisor before making any investment decisions. Visdom and its affiliates do not provide legal, tax or account advice so you should seek professional guidance if you have questions.