The opinions expressed below are my own and do not necessarily represent those of Visdom Investment Group, LLC.

Hope.

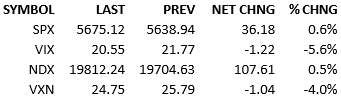

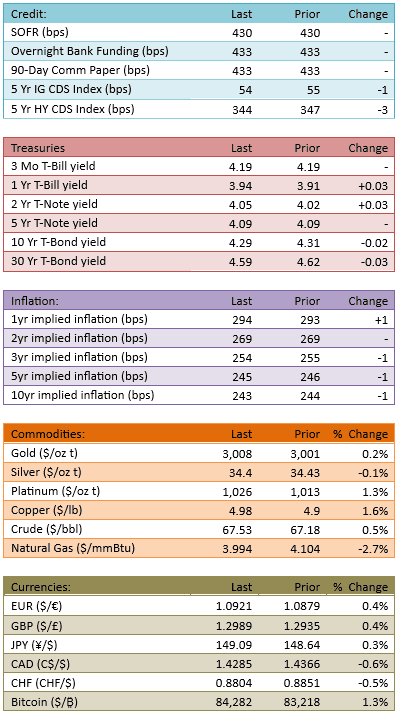

Futures were down modestly overnight and they began to climb higher around 4 AM. Retail sales data was mixed, with negative revisions across the board. Futures like the numbers however, maybe concluding that the retail bottom was last month. The S&P opened down small and rallied quickly into positive territory. The index chopped back to unch’d by noon and then took off higher around 1 PM. It never looked back. The yield curve twisted a little today, with front-end yields climbing and back-ends falling. Fed Funds expect 60 bips of cutting in 2025 now and less than a 1% chance of a Fed move on Wednesday.

The weekend didn’t soothe the bearish inclinations within the futures market but the investors that are active during regular trading hours were happy to extend Friday’s rally further. In a very surprising turn, the Mag 7 did not lead the market higher today. Real estate and energy were the best performing sectors.

It feels like today is a different world from Thursday. The S&P is ~ 155 points higher and almost every talking head on CNBC is talking about buying the dip and taking advantage of this correction. To say the market’s sentiment is highly path dependent is a heck of an understatement.

All the chart-traders are now eyeballing the 200-day moving average (5742). Bulls assume will pop above it shortly. This belief fosters the attitude of that last two days, that we’re not going to get prices below the 200-day anytime soon, so get busy buying.

I’m not sure how much fight the bears have in them. It seems like they’ve gotten out of Dodge on Friday and have no interest in coming back unless a big negative story breaks. If that’s true, the bulls are going to run until the news cycle smacks them upside the head.

Is there a headline like that lurking? Tariff talk could always be a culprit. Maybe the FOMC decision and press conference on Wednesday could be a bearish catalyst, though I doubt it. Maybe a bad weekly jobless print on Thursday could also break the tape.

Sentiment does its own thing when not buffeted by actual events. We’re in a period like that now. Sentiment is reacting to itself and news is immaterial. The bounce didn’t stop after one big up-session. Maybe it’ll extend for a few more too.

I wouldn’t bet on Thursday being the low for year right now. I also don’t know when it might get revisited. I do know that it’ll only take one bad headline in the next week or two for that to happen.

See you tomorrow.

-Mike

IMPORTANT INFORMATION

This is general educational information and market commentary and is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction.

All market and economic data herein is as of the date hereof and sourced from Bloomberg unless otherwise stated. The information is subject to change without notice and we have no obligation to update you.

This general market commentary is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. The views and opinions expressed constitute the author(s) judgment based on current market conditions, are subject to change without notice, and may differ from those expressed by other employees of Visdom Investment Group LLC ("Visdom") and Visdom. Past performance and any forward-looking statements are not guarantees of future results. It is not possible to invest directly in an index.

We believe the information contained in this material to be reliable and have sought to take reasonable care in its preparation; however, we do not represent or warrant its accuracy, reliability or completeness, or accept any liability for any loss or damage (whether direct or indirect) arising out of the use of all or any part of this material. Any securities referenced are shown for illustrative purposes only, and are not intended as a recommendation or endorsement by Visdom or by the author(s) in this context. The information presented is not intended to be making value judgments on the preferred outcome of any government decision. This information does not constitute Visdom research, nor should it be considered a recommendation of a particular investment strategy or an offer or solicitation for the purchase or sale of any financial instrument. Investing involves market risk, including the possible loss of principal. You should speak to your financial advisor before making any investment decisions. Visdom and its affiliates do not provide legal, tax or account advice so you should seek professional guidance if you have questions.