The opinions expressed below are my own and do not necessarily represent those of Visdom Investment Group, LLC.

Fresh highs.

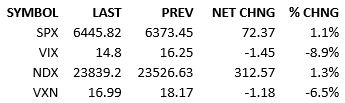

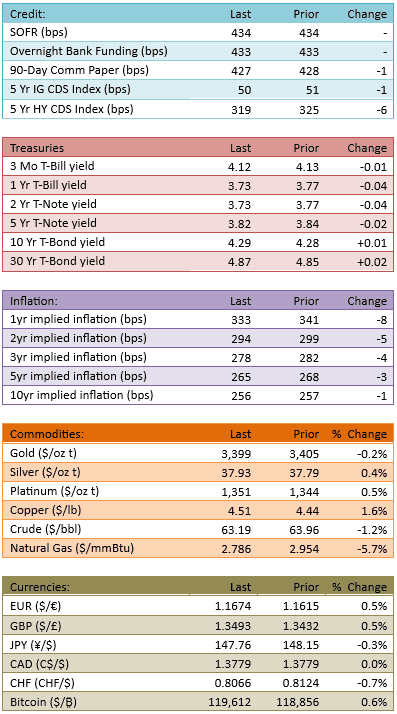

I guess the bulls were waiting for the inflation data. Futures were flat until CPI (2.7% vs 2.8% est & 2.7% prior). Under-the-hood details were also nice. Futures jumped up and yields jumped down. The S&P 500 opened about +30 and took an hour to bounce around, climbing steadily thereafter. Fed Funds futures moved in response to the CPI data as well. A rate cut on September 17 is now priced with 96% certainty. Total cuts for 2025 are 61 bips. Capital flow was a little higher today, 102%.

While the actual inflation data isn’t amazing, it is good enough to give the all-clear signal to stock investors. Apparently, would-be longs needed CPI assurance to put their capital to work. The Mag 7 led the way but the rally was broad too. Every sector climbed, with Communication Services and Information Technology leading.

With a potential stumbling block behind us, what’s the future hold for the stock market? Honestly, things look rosy. The chart is telling everyone, except the contrarians, to get long and stay strong. Fundamentals are positive and healthy. The fresh new all-time highs *confirm* the bullish trend for all the technicians. Psychologically, the new highs reinforce upside conviction in the market. Doubters and wait-and-see-ers, who wondered if the top was in, now have to come to Jesus.

The water looks warm, the returns are growing, the S&P is up 9.5% year to date. We’re almost at the double-digit gains that investors expect from annual returns in a bull market. If you don’t have 9% YTD yet, you have to hop on the bandwagon. Time is running out. Today may have been the final straw for any professional money managers that were underweight.

Obviously, the future can burn anyone and everyone. For the moment, capital has to flow into US stocks. The underperforming managers are going to lose capital to the outperformers, *if they don’t catch up.*

This means beta-chasing. This means winners are going to get even more attention. This means trends will extend.

See you tomorrow.

-Mike

IMPORTANT INFORMATION

This is general educational information and market commentary and is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction.

All market and economic data herein is as of the date hereof and sourced from Bloomberg unless otherwise stated. The information is subject to change without notice and we have no obligation to update you.

This general market commentary is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. The views and opinions expressed constitute the author(s) judgment based on current market conditions, are subject to change without notice, and may differ from those expressed by other employees of Visdom Investment Group LLC ("Visdom") and Visdom. Past performance and any forward-looking statements are not guarantees of future results. It is not possible to invest directly in an index.

We believe the information contained in this material to be reliable and have sought to take reasonable care in its preparation; however, we do not represent or warrant its accuracy, reliability or completeness, or accept any liability for any loss or damage (whether direct or indirect) arising out of the use of all or any part of this material. Any securities referenced are shown for illustrative purposes only, and are not intended as a recommendation or endorsement by Visdom or by the author(s) in this context. The information presented is not intended to be making value judgments on the preferred outcome of any government decision. This information does not constitute Visdom research, nor should it be considered a recommendation of a particular investment strategy or an offer or solicitation for the purchase or sale of any financial instrument. Investing involves market risk, including the possible loss of principal. You should speak to your financial advisor before making any investment decisions. Visdom and its affiliates do not provide legal, tax or account advice so you should seek professional guidance if you have questions.