The opinions expressed below are my own and do not necessarily represent those of Visdom Investment Group, LLC.

Snooze button.

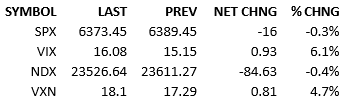

Headlines were of the minor variety this weekend and markets played along by doing very little. Overseas markets were mixed small and our markets followed suit. S&P futures traded slightly higher in the premarket but the index opened flat. We traded there until lunch, rallying quickly midday, only to roll over just as quickly, resulting in a slightly negative afternoon. Yields did little and Fed Funds futures haven’t changed significantly since Friday.

Financial news is chattering up a storm as the list of potential Fed Chairman grows. Who knows how people end up on Trump’s consideration list? As of today, the list has the following names:

As names get added to the list, financial news outlets scramble but markets yawn. I’m not sure which individuals markets favor and dislike. At this point, it’s an interesting bake-off but without significant market consequences. Maybe that changes as favorites emerge? As it currently stands, it’s just an example of news that’s worth mentioning but not affecting things.

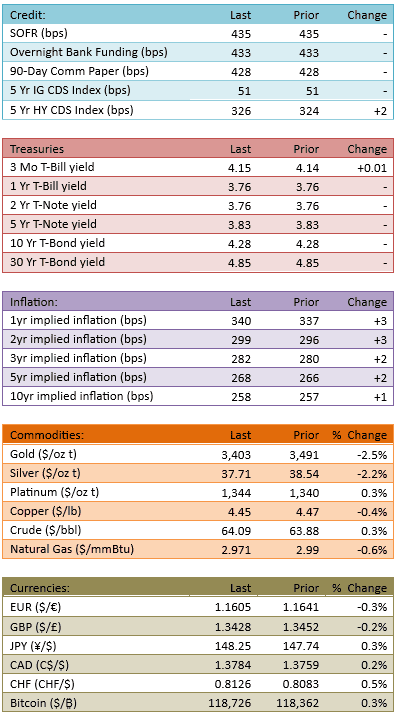

Tomorrow we will learn the latest datapoint for July CPI (2.8% est vs 2.7% prior). There’s financial outlet chatter about this too: that it will be a significant catalyst for the market tomorrow. Perhaps the importance of the inflation data is keeping investors paused today? Seems plausible but I’m not compelled by the idea either. Certainly if CPI is a big surprise, markets will shake. What if the print is in line? I don’t think investors are going to jump into motion if the number is a bullseye.

We’ll see. For a quiet day in August, looking ahead just a little with an eye towards pending action, makes for good conversation.

See you tomorrow.

-Mike

IMPORTANT INFORMATION

This is general educational information and market commentary and is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction.

All market and economic data herein is as of the date hereof and sourced from Bloomberg unless otherwise stated. The information is subject to change without notice and we have no obligation to update you.

This general market commentary is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. The views and opinions expressed constitute the author(s) judgment based on current market conditions, are subject to change without notice, and may differ from those expressed by other employees of Visdom Investment Group LLC ("Visdom") and Visdom. Past performance and any forward-looking statements are not guarantees of future results. It is not possible to invest directly in an index.

We believe the information contained in this material to be reliable and have sought to take reasonable care in its preparation; however, we do not represent or warrant its accuracy, reliability or completeness, or accept any liability for any loss or damage (whether direct or indirect) arising out of the use of all or any part of this material. Any securities referenced are shown for illustrative purposes only, and are not intended as a recommendation or endorsement by Visdom or by the author(s) in this context. The information presented is not intended to be making value judgments on the preferred outcome of any government decision. This information does not constitute Visdom research, nor should it be considered a recommendation of a particular investment strategy or an offer or solicitation for the purchase or sale of any financial instrument. Investing involves market risk, including the possible loss of principal. You should speak to your financial advisor before making any investment decisions. Visdom and its affiliates do not provide legal, tax or account advice so you should seek professional guidance if you have questions.