The opinions expressed below are my own and do not necessarily represent those of Visdom Investment Group, LLC.

Dipsy-do

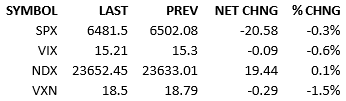

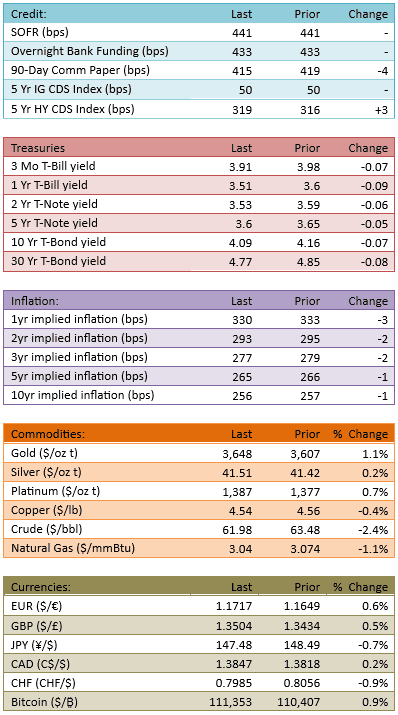

Nonfarm payrolls (+22k vs +75k est & +79k prior revised from +73k) were weak. Bonds rallied immediately as markets priced a 25 bip cut in September with greater than 100% certainty. An October cut jumped in probability too and talk of a 50 bip cut in September sprung to life. Equity futures rallied strongly as a result of the projected lower interest rates and Treasury yields came down about 6-9 bips across the curve. The S&P 500 opened up about 26 points, setting new all-time highs but fell down around 10 AM and went negative 15 minutes later. The rest of the day, stocks bumped along in negative territory, slowly clawing back some value. Capital flow was heavy at 123%.

Nobody has a clear cause behind the equity market’s slide after the open. Some argue that the labor number was too weak, suggesting that the Fed is behind the curve and that recession potential is climbing again. Until we hear different, that’s probably the best rationale. Lower rates will certainly help valuations and spur economic activity, but if the tariff damage, or other economic influences, have shifted the economy towards contraction too greatly, we’re in for trouble.

As it stands, the market is not too worried. If recession were considered likely, we’d be down multiple percent.

I think the market is now re-sensitized to recession risk. This has happened many times before over the year. The old playbook tells us to watch the trickle of economic releases closely and extrapolate the health of the economy as we gather info.

If the data shows US economic resilience, as it did before, each data point will spur a rally. The opposite is also true.

At this point, I’d consider the legacy momentum to be dead. We’re in a new phase. It’s the show-me phase.

If data shows health, buyers will generate new highs. New data will create new momentum. Just following the chart and hopping on probably isn’t the play.

Of course, if data prints nicely for a couple of weeks, the longer-term chart will look even better and more prophetic and momentum will build from there.

PPI and CPI will be key releases next Wednesday and Thursday.

Have a great weekend, see you Monday.

-Mike

IMPORTANT INFORMATION

This is general educational information and market commentary and is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction.

All market and economic data herein is as of the date hereof and sourced from Bloomberg unless otherwise stated. The information is subject to change without notice and we have no obligation to update you.

This general market commentary is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. The views and opinions expressed constitute the author(s) judgment based on current market conditions, are subject to change without notice, and may differ from those expressed by other employees of Visdom Investment Group LLC ("Visdom") and Visdom. Past performance and any forward-looking statements are not guarantees of future results. It is not possible to invest directly in an index.

We believe the information contained in this material to be reliable and have sought to take reasonable care in its preparation; however, we do not represent or warrant its accuracy, reliability or completeness, or accept any liability for any loss or damage (whether direct or indirect) arising out of the use of all or any part of this material. Any securities referenced are shown for illustrative purposes only, and are not intended as a recommendation or endorsement by Visdom or by the author(s) in this context. The information presented is not intended to be making value judgments on the preferred outcome of any government decision. This information does not constitute Visdom research, nor should it be considered a recommendation of a particular investment strategy or an offer or solicitation for the purchase or sale of any financial instrument. Investing involves market risk, including the possible loss of principal. You should speak to your financial advisor before making any investment decisions. Visdom and its affiliates do not provide legal, tax or account advice so you should seek professional guidance if you have questions.