The opinions expressed below are my own and do not necessarily represent those of Visdom Investment Group, LLC.

September jitters

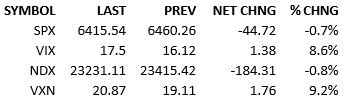

S&P 500 futures were flat at 3 AM and then Europe opened and traded down and took our futures down in sympathy. The index opened down about 85 points, recovered a bit, fell to down 100 at noon, and then recovered significantly in the afternoon. Capital flow was 107% today, suggesting the summer apathy is behind us. The Treasury curve steepened a bit, perhaps reflecting an appeals court decision striking down the President’s tariffs.

September is well known to be the seasonally worst month for US stocks. Given that plus Friday’s drop after Thursday’s all-time highs and you have a compelling case for active equity players to sell first, think second, and plan on jumping back in later.

If we get a couple of positive datapoints or developments, the upward chase will be potent. We have to get them first though. In the meantime, there are a lot of gains on the table that investors appear to be locking in. Are we at the start of a nasty stretch or is this yet another quick and shallow dip?

The pattern of the market over the last couple of months has been one of caution ahead of data/policy, and then bullish reaction thereafter. The market has not front-run data/policy since Liberation Day. Assuming that markets will stay the course, the next datapoint that could/should set prices into motion is August nonfarm payrolls data (+75k est vs +73k prior), releasing Friday morning.

Last week I didn’t think anything but an outlier would change market psychology. I believe it still today. I have not seen indicative data to suggest that payrolls will be surprising. Additionally, we haven’t had any big headlines or geopolitical events in August that could have rattled the US labor market. My point is that all the economic data has been smooth and stable for a while and there’s been no out-of-left-field shock that changed the jobs space faster than the data could reflect.

I therefore think that the numbers will print without drama. And this will allow all the worries from Friday and today, and maybe the next couple of days, to vanish.

The big picture of the economy remains unaltered from last week, month, and quarter. And that picture is rosy.

September seasonality fears may have popped up lately but they will not last if the data continues to paint a positive picture.

I think dip-buyers are licking their chops but most are sitting on their hands.

We’ll get the verdict on Friday. Maybe some other data before then will give us a hint though.

See you tomorrow.

-Mike

IMPORTANT INFORMATION

This is general educational information and market commentary and is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction.

All market and economic data herein is as of the date hereof and sourced from Bloomberg unless otherwise stated. The information is subject to change without notice and we have no obligation to update you.

This general market commentary is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. The views and opinions expressed constitute the author(s) judgment based on current market conditions, are subject to change without notice, and may differ from those expressed by other employees of Visdom Investment Group LLC ("Visdom") and Visdom. Past performance and any forward-looking statements are not guarantees of future results. It is not possible to invest directly in an index.

We believe the information contained in this material to be reliable and have sought to take reasonable care in its preparation; however, we do not represent or warrant its accuracy, reliability or completeness, or accept any liability for any loss or damage (whether direct or indirect) arising out of the use of all or any part of this material. Any securities referenced are shown for illustrative purposes only, and are not intended as a recommendation or endorsement by Visdom or by the author(s) in this context. The information presented is not intended to be making value judgments on the preferred outcome of any government decision. This information does not constitute Visdom research, nor should it be considered a recommendation of a particular investment strategy or an offer or solicitation for the purchase or sale of any financial instrument. Investing involves market risk, including the possible loss of principal. You should speak to your financial advisor before making any investment decisions. Visdom and its affiliates do not provide legal, tax or account advice so you should seek professional guidance if you have questions.