The opinions expressed below are my own and do not necessarily represent those of Visdom Investment Group, LLC.

Slow and steady.

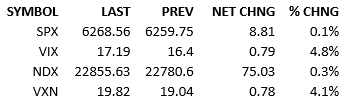

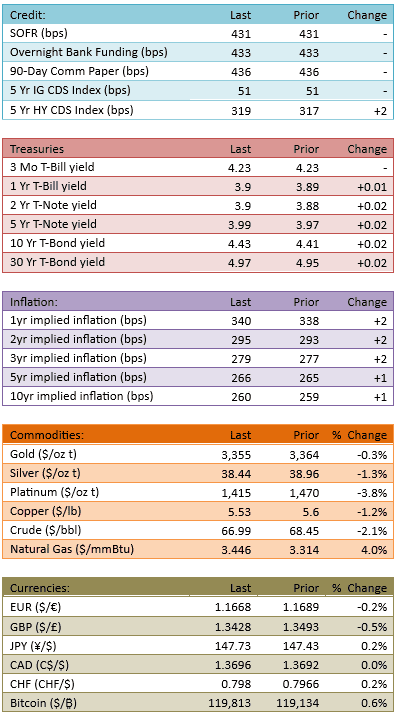

Tariff-talk 2.0 shook up markets over the weekend and S&P 500 futures traded off anywhere from 30-40 points last night and early this morning. Relative to what tariff-talk 1.0 did back in March and April, this is trivial. Anyway talk 2.0 still generates risk-off moves in the markets and our drop in futures led to a down open, with the S&P starting about -10 points. As the morning progressed, we bobbed around a bit, with only a hint of the early trading weakness that was common last week. The typical strength began in the mid-morning trading and calm buying stuck around for the afternoon, just like last week. Yields increased small today, so bonds didn’t influence investors much and 2025 Fed cuts were about unchanged, prices at 49 bips today.

It's interesting to note the intraday patterns from last week are continuing. The pulse of selling shortly after the open is there but much less. The response of the buyers is unchanged. The steadiness of the bulls in the afternoon is obvious as well. What’s going on out there? Why are the risk-off players operating in the premarket and the first 30 minutes of trading? Why are the bulls the only players that matter thereafter?

I don’t have a good guess as to why the bears and the bulls have been on such predictable schedules lately. I know it will change I just don’t know when. That said, since the bulls always win out, one can say that this pattern of the market is a sign of the current bull run. As long as it continues, I think a gentle bull run will result.

Of course, news and data and earnings are around the corner so these patterns may disappear simply due to catalysts. We’ll see soon. CPI prints tomorrow, PPI prints Wednesday, and the big banks launch earnings season tomorrow morning.

The tone of the market is one of optimism. The narrative is that inflation will be fine, whether it’s off the mark small or not won’t matter. The view is that inflation isn’t going to surprise us *so* much that the expectations for the economy and the Fed shift. Famous last words maybe.

More important than the coming inflation data is the coming earnings reports. The Street thinks the numbers will be good and the guidance will be better. The proof will be in the pudding but it sure seems like investors are on rails currently and companies aren’t going to blow up the track.

On to tomorrow. See you then.

-Mike

IMPORTANT INFORMATION

This is general educational information and market commentary and is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction.

All market and economic data herein is as of the date hereof and sourced from Bloomberg unless otherwise stated. The information is subject to change without notice and we have no obligation to update you.

This general market commentary is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. The views and opinions expressed constitute the author(s) judgment based on current market conditions, are subject to change without notice, and may differ from those expressed by other employees of Visdom Investment Group LLC ("Visdom") and Visdom. Past performance and any forward-looking statements are not guarantees of future results. It is not possible to invest directly in an index.

We believe the information contained in this material to be reliable and have sought to take reasonable care in its preparation; however, we do not represent or warrant its accuracy, reliability or completeness, or accept any liability for any loss or damage (whether direct or indirect) arising out of the use of all or any part of this material. Any securities referenced are shown for illustrative purposes only, and are not intended as a recommendation or endorsement by Visdom or by the author(s) in this context. The information presented is not intended to be making value judgments on the preferred outcome of any government decision. This information does not constitute Visdom research, nor should it be considered a recommendation of a particular investment strategy or an offer or solicitation for the purchase or sale of any financial instrument. Investing involves market risk, including the possible loss of principal. You should speak to your financial advisor before making any investment decisions. Visdom and its affiliates do not provide legal, tax or account advice so you should seek professional guidance if you have questions.