The opinions expressed below are my own and do not necessarily represent those of Visdom Investment Group, LLC.

The game has changed.

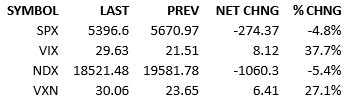

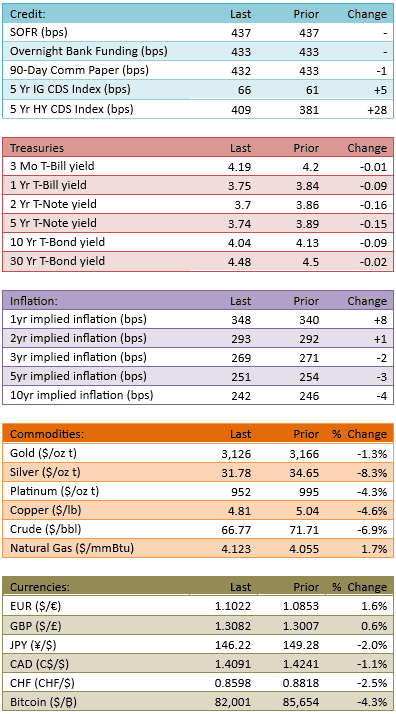

You don’t need me to recap today’s carnage. It began shortly after the Rose Garden announcement and it only got worse over time. Yields fell a lot. Current Fed cuts for 2025 are priced at 93 bips. The Dollar fell 1.5%, a huge move. Commodities suffered badly too. Markets experienced shock and awe.

Let’s discuss.

Forget the politics. The tariffs will make most everything more expensive for everyone along the supply chain. The consumer will feel it last but everyone will feel it in some capacity. Who-feels-how-much-pain is a sideshow question not worth addressing. In the aggregate, demand will drop. This will be global. How much? I don’t know. However we were already slowing in the US and this will probably push us into a recession. Direct calculations are bouncing around that don’t show a trued GDP contraction but the psychological and higher-order effects are not in those numbers. Risk appetites are materially diminished and they won’t just bounce back, nor will they simply hold at today’s levels, whatever those might be.

I’m not talking about the stock market risk appetite either. I’m talking about purchase orders in the real economy. I’m talking about capital expenditures. I’m talking about consumer budgets. The global population of economic actors, large and small, just got a stiff punch in the nose and the collective reaction will be to spend less, do less, expand less, and wait out the storm. That will have a consequence. It won’t be positive and it won’t be of the size of these initial estimates from the economist community.

Here’s my point. The stock market is not ready for a recession. The stock market thinks that this is bad but not recession-bad. In the short run, we may get some recovery in the S&P. We may get some amazing rallies but I think the next month or two will send us lower.

I don’t think we bottom until we see a negative GDP print *and* we think we already hit bottom.

That’s off in the future. My optimistic guess is 1-2 months. My realistic guess is a few months longer. That’s not good.

I honestly wonder how much more downside there might be. A bear market would only be official if the S&P fell to 4900, about 10% lower.

Are we in a bear? Is it too late to rotate or cash out? I don’t have conviction but my gut says it’s not too late to de-risk.

See you tomorrow.

-Mike

IMPORTANT INFORMATION

This is general educational information and market commentary and is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction.

All market and economic data herein is as of the date hereof and sourced from Bloomberg unless otherwise stated. The information is subject to change without notice and we have no obligation to update you.

This general market commentary is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. The views and opinions expressed constitute the author(s) judgment based on current market conditions, are subject to change without notice, and may differ from those expressed by other employees of Visdom Investment Group LLC ("Visdom") and Visdom. Past performance and any forward-looking statements are not guarantees of future results. It is not possible to invest directly in an index.

We believe the information contained in this material to be reliable and have sought to take reasonable care in its preparation; however, we do not represent or warrant its accuracy, reliability or completeness, or accept any liability for any loss or damage (whether direct or indirect) arising out of the use of all or any part of this material. Any securities referenced are shown for illustrative purposes only, and are not intended as a recommendation or endorsement by Visdom or by the author(s) in this context. The information presented is not intended to be making value judgments on the preferred outcome of any government decision. This information does not constitute Visdom research, nor should it be considered a recommendation of a particular investment strategy or an offer or solicitation for the purchase or sale of any financial instrument. Investing involves market risk, including the possible loss of principal. You should speak to your financial advisor before making any investment decisions. Visdom and its affiliates do not provide legal, tax or account advice so you should seek professional guidance if you have questions.